In the fast-paced world of finance, where split-second decisions can lead to significant gains or catastrophic losses, the allure of automated trading systems has captured the imagination of investors and traders alike. Imagine a world where your trading strategies execute flawlessly, free from the emotional rollercoaster that often accompanies manual trading.

Building a profitable automated trading system from scratch might seem daunting, yet it offers the promise of consistent returns and a level of efficiency that manual operations simply can’t match. This article will guide you through the intricate process of creating your own trading algorithm, exploring the essential components, tools, and strategies you’ll need to navigate this complex landscape.

Whether you’re a curious novice or an experienced trader looking to enhance your toolkit, youre about to embark on a journey that demystifies the art and science of automated trading. Ready to dive in? Let’s get started.

Introduction to Automated Trading Systems

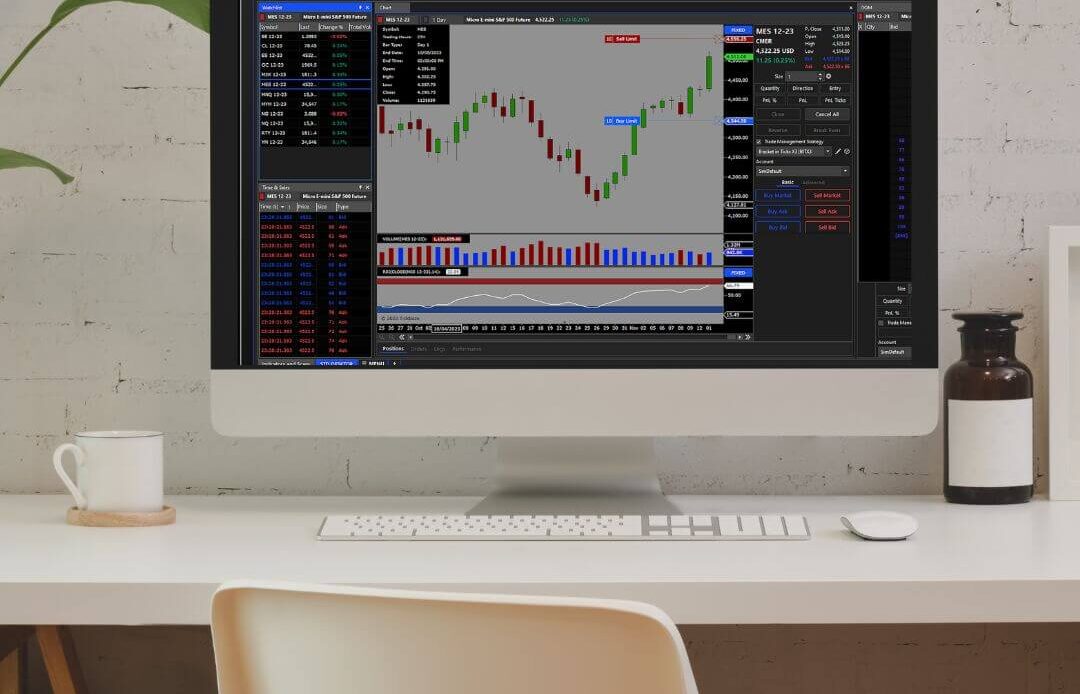

Automated trading systems, often heralded as the future of financial markets, transform the way traders interact with the complexities of buying and selling. These sophisticated algorithms operate around the clock, executing trades at lightning speed, far beyond the capabilities of human traders.

But what lies beneath the surface? At their core, automated trading systems, powered by automated trading software, utilize data-driven strategies that incorporate various indicators and market conditions to make informed decisions without human emotion or intervention. However, the allure of automation isn\’t merely in its speed; it hinges on the potential to analyze vast amounts of data, spotting trends and anomalies that may elude even the most seasoned trader.

As you dive deeper into the intricate world of automated trading, you\’ll discover not just the mechanics but also the art of crafting a system tailored to your unique trading style and risk appetite. With the right foundation and understanding, you can harness this innovation to carve out a profitable niche in the bustling marketplace.

Risk Management and Capital Allocation

Risk management and capital allocation form the backbone of any successful automated trading system, ensuring that your algorithm not only seeks profit but does so with a calculated approach to potential losses. Imagine setting sail on an unpredictable ocean; you wouldn’t navigate without a compass, nor would you overload your vessel.

Similarly, in trading, it’s essential to establish strict risk parameters—these might include stop-loss orders, diversification across asset classes, and position sizing that aligns with your overall risk tolerance. Consider a scenario where your algorithm identifies a seemingly lucrative opportunity, yet fails to account for unexpected market volatility.

Without a robust risk management framework, that chance for profit could swiftly morph into significant losses. Therefore, effective capital allocation becomes imperative; it’s about deploying your resources strategically, ensuring that your investments are not only positioned to capture upside potential but also insulated against downside risks.

Striking the right balance can mean the difference between a thriving trading system and one that capsizes under pressure.

Staying Updated with New Technologies and Strategies

In the fast-paced landscape of automated trading, staying updated with new technologies and strategies is not just advantageous; it’s essential for success. As markets evolve, so too do the tools and algorithms that drive trading efficiency and profitability.

Regularly engaging with industry news, attending webinars, and contributing to forums can expose you to cutting-edge developments that might otherwise fly under the radar. From machine learning advancements to innovative backtesting techniques, each new breakthrough could present a significant opportunity—or a potential risk.

Embrace a mindset of continual learning, for a proactive approach to the latest trends can enhance your system’s performance and adaptability. Moreover, the integration of social trading platforms and AI-driven analytics into your strategy might reveal rich insights that transform your trading landscape.

Remember, in this arena, stagnation equates to obsolescence, so ensure your knowledge is as dynamic as the markets you trade in.

Conclusion

In conclusion, building a profitable automated trading system from scratch is a multifaceted endeavor that requires careful planning, diligent coding, and ongoing optimization. By thoroughly understanding the market dynamics, selecting the right strategies, and continuously backtesting your approach, you can create a system that not only performs effectively but also adapts to changing market conditions.

The integration of automated trading software can significantly enhance your efficiency and precision, allowing you to execute trades with minimal emotional interference. Ultimately, with perseverance and a commitment to refining your system, you can achieve consistent profitability in the world of automated trading.